Some Known Facts About G. Halsey Wickser, Loan Agent.

Table of ContentsAn Unbiased View of G. Halsey Wickser, Loan AgentAn Unbiased View of G. Halsey Wickser, Loan AgentFascination About G. Halsey Wickser, Loan AgentLittle Known Questions About G. Halsey Wickser, Loan Agent.About G. Halsey Wickser, Loan Agent

They may bill lending origination charges, ahead of time fees, financing administration costs, a yield-spread costs, or just a broker commission. When functioning with a home loan broker, you should clarify what their charge structure is early on while doing so so there are not a surprises on closing day. A mortgage broker normally only earns money when a finance closes and the funds are released.Most of brokers don't cost consumers anything in advance and they are usually risk-free. You should use a home mortgage broker if you intend to find access to mortgage that aren't conveniently promoted to you. If you don't have outstanding credit scores, if you have a special loaning situation like possessing your own company, or if you simply aren't seeing home mortgages that will certainly benefit you, after that a broker may be able to get you access to car loans that will certainly be beneficial to you.

Home mortgage brokers may likewise have the ability to help loan candidates receive a reduced rate of interest than many of the industrial car loans offer. Do you need a mortgage broker? Well, collaborating with one can conserve a debtor time and initiative throughout the application procedure, and potentially a great deal of money over the life of the funding.

How G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.

A specialist mortgage broker originates, works out, and processes residential and business mortgage in support of the client. Below is a 6 point overview to the solutions you need to be supplied and the expectations you need to have of a professional mortgage broker: A home loan broker provides a vast array of mortgage from a variety of various lenders.

A home mortgage broker represents your interests instead than the passions of a lending establishment. They should act not just as your agent, however as an educated expert and problem solver - california mortgage brokers. With access to a large range of home mortgage items, a broker is able to supply you the biggest value in terms of rates of interest, payment quantities, and lending products

Lots of circumstances demand even more than the basic use of a 30 year, 15 year, or flexible price home loan (ARM), so cutting-edge home loan strategies and innovative remedies are the advantage of functioning with a skilled home loan broker. A mortgage broker navigates the client with any type of circumstance, dealing with the process and smoothing any type of bumps in the roadway in the process.

Some Known Factual Statements About G. Halsey Wickser, Loan Agent

Debtors that discover they need larger car loans than their financial institution will approve also gain from a broker's expertise and ability to effectively acquire financing. With a mortgage broker, you only require one application, instead than completing types for each private lending institution. Your mortgage broker can provide a formal contrast of any financings advised, leading you to the details that precisely depicts price differences, with present prices, factors, and closing expenses for each and every lending mirrored.

A credible mortgage broker will disclose exactly how they are paid for their services, as well as detail the complete prices for the loan. Customized solution is the setting apart aspect when picking a home mortgage broker. You need to expect your home mortgage broker to assist smooth the method, be offered to you, and recommend you throughout the closing procedure.

The journey from dreaming concerning a new home to in fact owning one may be full of challenges for you, specifically when it (https://pbase.com/halseyloanagt/g_halsey_wickser_loan_agent) comes to securing a home loan in Dubai. If you have been presuming that going straight to your bank is the most effective path, you could be losing out on an easier and potentially extra valuable choice: dealing with a mortgages broker.

An Unbiased View of G. Halsey Wickser, Loan Agent

Among the significant advantages of making use of a home loan specialist is the professional monetary advice and necessary insurance assistance you get. Home mortgage experts have a deep understanding of the numerous monetary products and can aid you select the best mortgage insurance coverage. They ensure that you are sufficiently covered and give guidance tailored to your monetary scenario and long-term goals.

This process can be difficult and time-consuming for you. A home mortgage brokers take this problem off your shoulders by managing all the documents and application processes. They know specifically what is needed and ensure that everything is finished precisely and on schedule, minimizing the threat of hold-ups and errors. Time is money, and a home loan broker can save you both.

This indicates you have a far better opportunity of locating a mortgage in the UAE that flawlessly matches your requirements, consisting of specialized products that may not be offered via traditional financial networks. Browsing the home mortgage market can be confusing, especially with the myriad of products available. A provides professional assistance, assisting you comprehend the advantages and disadvantages of each choice.

Not known Details About G. Halsey Wickser, Loan Agent

This professional suggestions is vital in protecting a home loan that aligns with your financial objectives. Home loan advisors have actually developed relationships with many lenders, providing them significant discussing power.

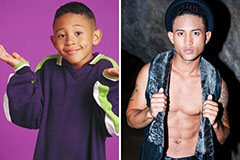

Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!